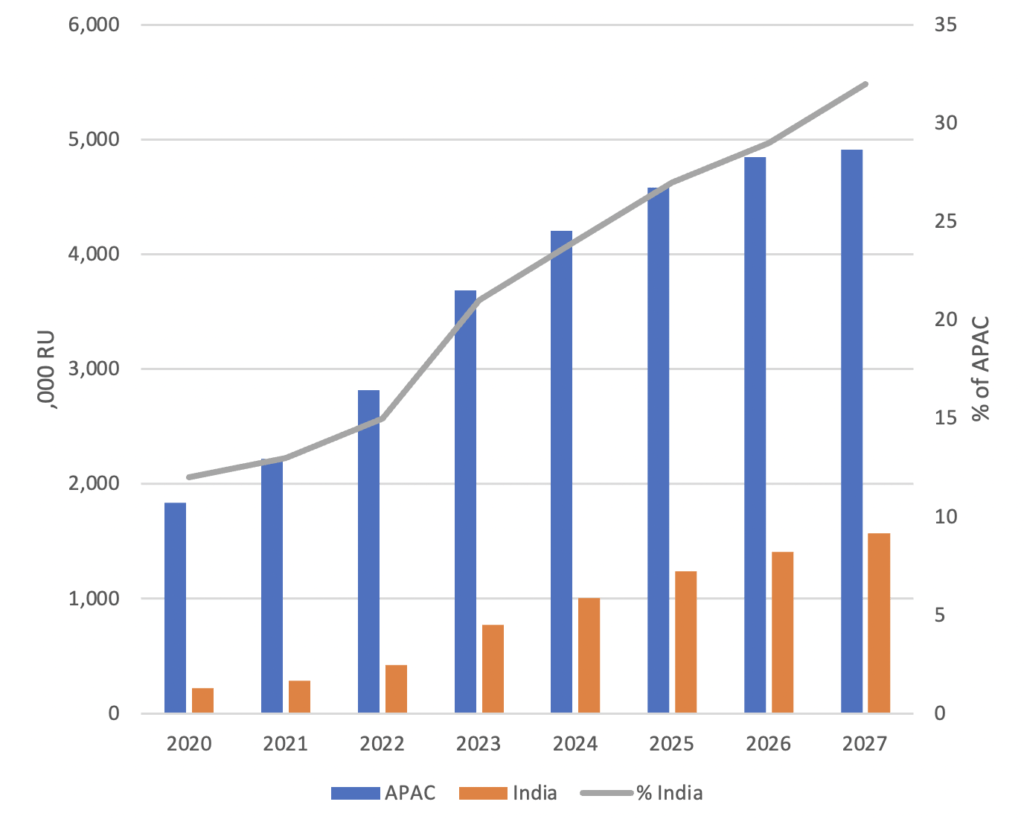

Last month finally saw India’s telecoms regulator, TRAI, concluding the country’s first auction of 5G spectrum, after many delays and disputes. This will kickstart one of the world’s largest roll-outs of 5G networks, in deployments that are expected to include a large number of small cells from the first phase. If the leading operators stick to the plans they are discussing in the wake of the auction, India could account for almost one-third of total small cell deployments in 2027.

The auction raised a total of INR1.5 trillion ($19bn) for spectrum in the 700 MHz, 800 MHz, 1.8 GHz, 3.3 GHz and 26 GHz 5G bands. The biggest spender was Reliance Jio, the mobile market leader, which paid $11.15bn, partly because it focused on the highly-valued sub-GHz bands, as well as midband and high frequency spectrum. The other two MNOs, Bharti Airtel and Vodafone Idea, did not bid for sub-GHz spectrum. There was also one new entrant, Adani Group.

Jio is likely to lead the deployment of 5G small cells, driving considerable scale into the market, as it will be building on expertise and tools that it has already pioneered in 4G. It plans to deploy 5G Standalone from day one, which will enable it to use the capabilities of the 5G core to maximize value from its dense networks, for instance with network slicing.

While Jio’s low-band spectrum will enable it to build out broad 5G coverage cost-effectively, it also plans to use its 1,000 MHz of millimeter wave spectrum to support enterprise and industrial networks, which will involve small cell roll-outs to target India’s huge base of small and medium enterprises (SMEs). Jio has already been a leader in small cell deployment in its 4G network, claiming the world record for the numbers of indoor, outdoor and enterprise devices it has provisioned. It will now build on that experience in densification to plan a 5G network that balances coverage with targeted capacity in order to support a wide range of consumer and industry services.

To intensify the focus on enterprise small cell networks, Jio Platforms – the division of Reliance Industries that houses Jio – has developed a series of platforms that support the management of small cells, including AI-driven automation, along with back office functions, and specific vertical industry capabilities. The group will now market these developments to other operators round the world on an as-a-service basis.

Bharti Airtel also has its eyes on enterprise and private networks, deploying small cells in its new midband and millimeter wave spectrum to densify its national midband 5G macro roll-out. Airtel has been a prominent participant in open RAN trials and is expected to drive the adoption of open interfaces in India. Meanwhile, new entrant Adani will solely target enterprise and private networks, and so represents a new adopter of small cell technology in this space in India.

The Indian auction may have come relatively late, but this will enable the operators to make use of technologies and products that are reasonably mature, and to deploy at an accelerated pace. Jio has pledged to spend $25bn to get 5G to all cities by the end of 2023. For the first time, India has the potential to leapfrog some other mobile economies and provide world-class mobile services. To be able to afford to invest in quality networks, the enterprise and private networks market, which is built on small cells, will be vital to generate the new revenues and improved ARPUs that will always be challenging to achieve in the budget-conscious consumer space.

The build-out plans of Jio and Airtel are projecting breakneck pace of deployment, but the operators are building on years of work that has gone into creating partnerships and ecosystems in India. The major operators have significant co-developments with many suppliers, including for small cells, and both Jio and Airtel have major investments from hyperscalers such as AWS and Google – companies which aim to leverage partnerships with operators to target the huge growth potential for their services, among Indian consumers and SMEs. Google has, for instance, worked with Jio to develop a series of low cost Android smartphones, one of them for the new 5G network.

Co-developments like this push down the operators’ development costs and help them achieve scale quickly in technologies such as small cells and handsets. But perhaps the most important catalyst for 5G densification has come from the government, which recently amended the country’s Telegraph Right of Way (RoW) Rules of 2016, to facilitate the deployment of small cells.

The RoW application procedure has been simplified and allows operators to use street furniture at a nominal cost of INR150 ($1.80) per year in rural areas and INR300 ($3.70) in urban areas. Operators can now enter into agreements with private property owners to instal telecoms equipment, without requiring any approval from the government.

The government had already axed the administrative fee that it formerly charged to instal poles on its land, and placed caps on what local governments can charge for poles or fiber. Operators estimate that the new changes will reduce approval timelines for small cells to 15-30 days, and do away with many approvals processes. This has encouraged new trials and deployments. For instance, Vodafone Idea is conducting a trial using street furniture, such as traffic light poles, street lights, road signs and bus shelters, for small cells and aerial fiber in Bhopal in the state of Madhya Pradesh. This is part of a pilot conducted by regulatory TRAI to feed into 5G and smart city projects.

TRAI has also issued a consultation paper entitled ‘Use of Street Furniture for Small Cell and Aerial Fiber Deployment’. This says: “The use of higher frequency bands for 5G services would require that macrocells be complemented with extensive deployment of small cells so as to support all kinds of uses and applications, at all locations.”

Despite all these optimistic indicators for a rapid roll-out of 5G, including small cells, in India, there are challenges too. ARPUs remain very low, and all the operators have high debt levels and challenging balance sheets. There are uncertainties over how far demand, and willingness to pay, for 5G will drive migration from 4G services, which are still relatively new. And while Jio and Airtel have both been driving open, virtualized architectures forward, there are question marks over their maturity to address the diverse geographical and demographic requirements of Indian 5G.

These uncertainties make it particularly essential that the operators’ 5G platforms can be quickly monetized for enterprise and industrial purposes, not just for consumer applications, and in that process, rapid deployment of small cells looks highly strategic.